Homeowners Insurance in and around Lake in the Hills

If walls could talk, Lake in the Hills, they would tell you to get State Farm's homeowners insurance.

Help protect your home with the right insurance for you.

Would you like to create a personalized homeowners quote?

- Lake in the Hills IL

- Crystal Lake, IL

- Village of Lakewood

- Algonquin, IL

- Huntley, IL

- Hampshire, IL

- Marengo, IL

- Carpentersville, IL

- Dundee, IL

- Gilberts, IL

- Cary, IL

- East Troy, WI

- Sussex, WI

- Delevan, WI

- Lake Geneva, WI

- Mukwonago, WI

- Carmel, IN

- Noblesville, IN

- Woodstock, IL

- Oconomowoc, WI

Welcome Home, With State Farm Insurance

You want your home to be a place of rest after a stressful day at work. That doesn't happen when you're worrying about making sure you don't burn the cake, and especially if your home isn't insured. That's why you need us at State Farm, so all you have to worry about is the first part.

If walls could talk, Lake in the Hills, they would tell you to get State Farm's homeowners insurance.

Help protect your home with the right insurance for you.

Protect Your Home Sweet Home

From your home to your treasured keepsakes, State Farm is here to make sure your valuables are covered. Mark Krueger would love to help you understand your options.

When your Lake in the Hills, IL, home is insured by State Farm, even if something bad does happen, your most valuable asset may be covered! Call or go online today and see how State Farm agent Mark Krueger can help you protect your home.

Have More Questions About Homeowners Insurance?

Call Mark at (847) 515-2600 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Weatherproofing: how to prepare for a heat wave

Weatherproofing: how to prepare for a heat wave

As the summer approaches, it’s critical to consider how to prepare for extreme heat. We’ll discuss heat safety tips for your home and vehicle.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

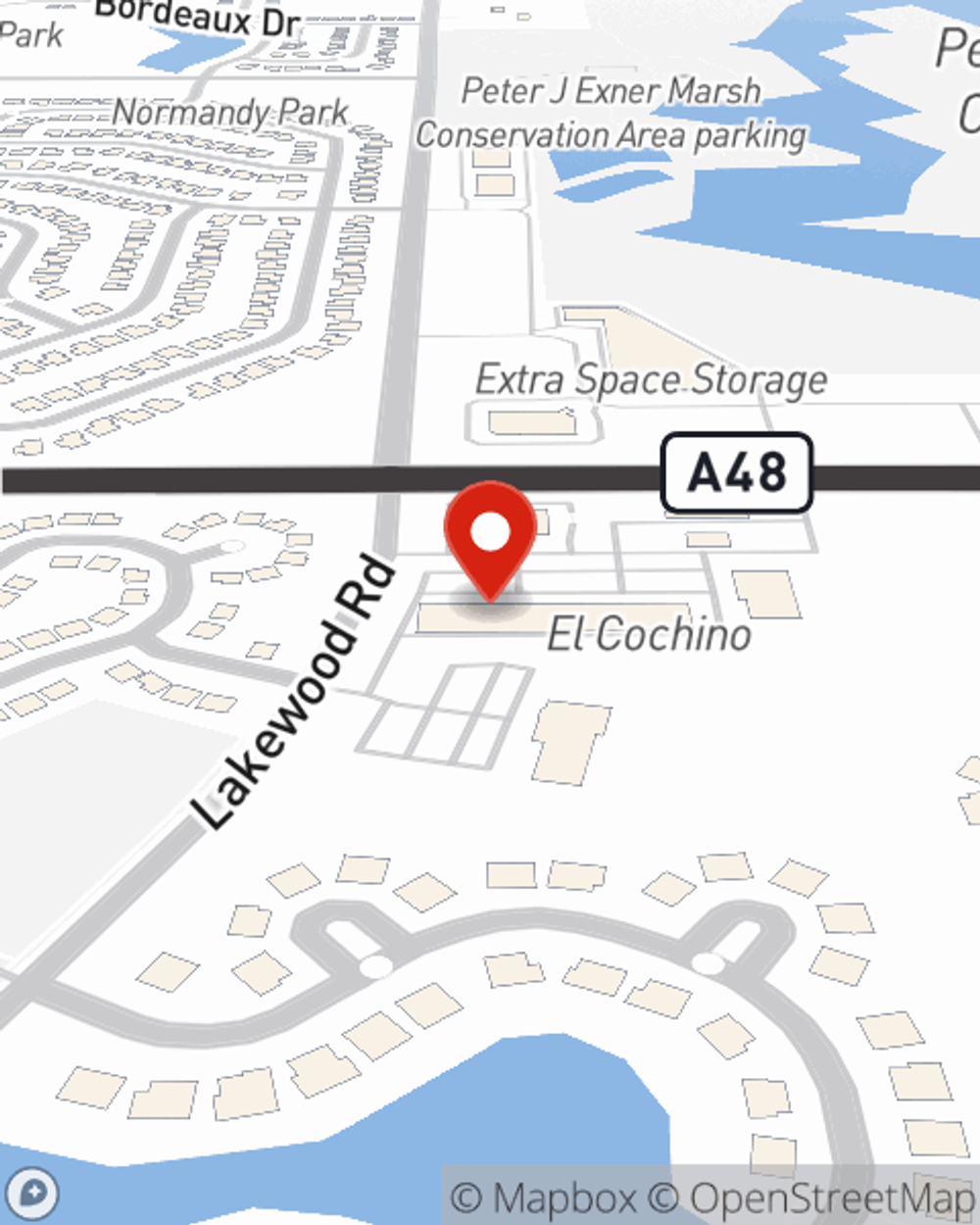

Mark Krueger

State Farm® Insurance AgentSimple Insights®

Weatherproofing: how to prepare for a heat wave

Weatherproofing: how to prepare for a heat wave

As the summer approaches, it’s critical to consider how to prepare for extreme heat. We’ll discuss heat safety tips for your home and vehicle.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.